Introduction

In the realm of digital finance, stability is a sought-after trait that many cryptocurrencies lack. However, USD Coin (USDC) stands out as a game-changer—a digital currency that offers stability and security. In this article, we will delve into the world of USD Coin, exploring its unique features, use cases, and advantages. Backed by U.S. dollar assets, USDC provides individuals and businesses with a reliable and efficient means of transacting value on the blockchain. Let’s explore the fascinating world of USD Coin and its potential to revolutionize the future of digital finance.

What Is USD Coin?

USD coins (USDC) are one type of digital currency or cryptocurrency. USD Coin (USDC) is a digital currency that represents U.S. dollars on the Ethereum blockchain

USDC is fully backed by U.S. dollar reserves held in custody by the issuing institutions. This means that for every USDC in circulation, an equivalent amount of U.S. dollars is held in reserve. The primary purpose of USDC is to provide stability and enable seamless transactions within the cryptocurrency ecosystem. With a 1:1 peg to the U.S. dollar, the value of one USDC coin is always intended to equal the value of one U.S. dollar. That’s why the USD coin is also called a stablecoin.

What is a stablecoin coin?

Stablecoins are that cryptocurrencies whose price doesn’t fluctuate much. The reason for their stability is that they are backed by some regular currency like dollars or euros or common assets. Some assets are kept in reserve and tokens are issued.

Now remember that USD Coin (USDC) is not directly issued by the U.S. government. USDC is created and issued by regulated financial institutions, such as Circle and Coinbase, which act as the issuers of digital currency. These institutions are responsible for ensuring that the USDC tokens in circulation are fully backed by U.S. dollar reserves held in custody.

Founders of USD Coin

USD Coin (USDC) was launched as a collaborative effort between two companies: Circle and Coinbase.

1. Circle: Circle is a fintech company founded in 2013 by Jeremy Allaire and Sean Neville.

-Jeremy Allaire is the co-founder of USD coin and Jeremy was the also founder of the circle. Jeremy Allaire is a famous technologist and internet entrepreneur.

-Sean Neville is the second co-founder of USD coin. Also, he has a senior software engineer at Jeremy’s company. Sean was the expert in the crypto world. At present Jeremy was president of products and operations at USD Coin.

Circle company provides various blockchain-based financial services and infrastructure, with a focus on stablecoins. Circle played a significant role in the development and launch of USDC.

2. Coinbase: Coinbase is a famous cryptocurrency exchange platform. That was founded in 2012 by Brian Armstrong and Fred Ehrsam. It allows users to buy, sell, and store various cryptocurrencies, including USDC.

Coinbase partnered with Circle to support the launch and adoption of USDC.

Together, Circle and Coinbase formed the Centre Consortium, a consortium created to govern and oversee the USDC stablecoin.

Understanding USD Coin

Certainly! Let’s break down the process and explain how USD Coin (USDC) maintains its 1:1 peg with the U.S. dollar.

When you initiate a transaction to buy one USD Coin using fiat currency, such as U.S. dollars, the process involves depositing and storing the equivalent amount of fiat currency as one U.S. dollar. This means that for every USDC token created, there is a corresponding U.S. dollar held in reserve. This ensures that the value of one USDC remains equivalent to one U.S. dollar.

To illustrate this, let’s say you want to purchase one USDC for $1. When you make the purchase, your $1 fiat currency is received, and one USDC token is minted and allocated to your digital wallet. The deposited fiat currency is securely held as a reserve backing that USDC.

if you decide to sell your USDC and exchange it for fiat currency, the USDC token is permanently burned and taken out of circulation. Simultaneously, the equivalent amount of U.S. dollars, based on the 1:1 peg, is transferred back to your bank account. This ensures that the supply of USDC in circulation decreases, maintaining the balance between the number of tokens and the underlying U.S. dollar reserves.

Following this process of minting and burning USDC tokens about the inflow and outflow of fiat currency, the stability and peg of 1 USDC to 1 U.S. dollar are maintained. It gives users confidence that each USDC they hold is backed by real U.S. dollar reserves, making USDC a stablecoin within the cryptocurrency ecosystem.

It’s important to note that the specific mechanisms of minting and burning USDC may involve various technical and operational processes implemented by the issuers and ecosystem participants.

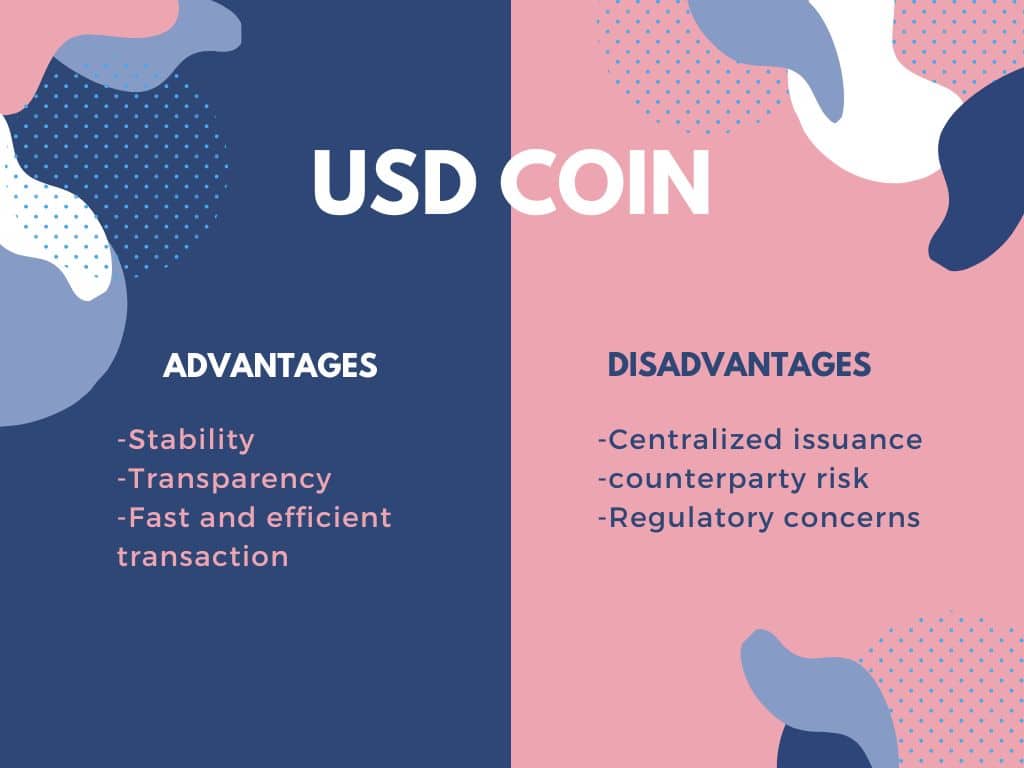

Advantages and Disadvantages of USD Coin

Is Investing in USD Coin Risky?

Investing in USD Coin (USDC) carries a different set of risks compared to investing in other types of cryptocurrencies or traditional investments. Here are some critical risks associated with investing in USDC:

Counterparty Risk: While USDC aims to be fully backed by reserves of fiat currency, there is still a level of counterparty risk involved. The stability and trustworthiness of USDC depend on the entities holding the reserves and conducting regular audits. If these entities face financial difficulties or fail to maintain proper backing, it could impact the value and stability of USDC.

Regulatory Risks: Stablecoins, including USDC, are subject to regulatory scrutiny and potential changes in regulations. Regulatory actions or restrictions on stablecoins could affect their availability or impose additional compliance requirements, which may introduce uncertainties for investors.

Market and Liquidity Risks: Although USDC is designed to maintain a 1:1 peg with the US dollar, there could be temporary fluctuations in its value due to market dynamics. Additionally, investing in USDC may involve liquidity risks. If insufficient demand or limited trading platforms is supporting USDC, it could impact the ease of buying or selling the token.

Limited Investment Returns: Unlike other cryptocurrencies or investment assets that can appreciate in value, the primary purpose of USDC is to provide stability and serve as a digital representation of the US dollar. Therefore, investing in USDC does not generally offer the potential for significant investment returns.

Conclusion

In conclusion, USD Coin (USDC) stands out as a stable coin that offers stability and security in the realm of digital finance.

With its 1:1 peg to the U.S. dollar, USDC provides individuals and businesses with a reliable and efficient means of transacting value on the blockchain.

Fully backed by the U.S. dollar reserves held in custody by regulated financial institutions, USDC ensures that each token is backed by real-world assets.

The collaborative efforts of Circle and Coinbase, as well as the establishment of the Centre Consortium, have played a crucial role in the development and governance of USDC.

By leveraging the Ethereum blockchain, USDC enables seamless transactions within the cryptocurrency ecosystem, bringing stability and trust to the digital finance space.

FAQS

What is the purpose of USD Coin (USDC)?

The purpose of the USD Coin is to provide stability and security in the world of digital finance. It offers a 1:1 peg to the U.S. dollar, ensuring that each USDC token is backed by real-world U.S. dollar reserves. USDC enables individuals and businesses to transact value on the blockchain with confidence.

How is USD Coin maintained at a 1:1 peg with the U.S. dollar?

USD Coin maintains its 1:1 peg with the U.S. dollar through a process of minting and burning tokens. For every USDC token created, an equivalent amount of U.S. dollars is held in reserve.

When USDC is exchanged for fiat currency, the token is burned, and the corresponding amount of U.S. dollars is transferred back to the user’s bank account.

Who are the founders of USD Coin?

USD Coin was launched as a collaborative effort between Circle and Coinbase.

Jeremy Allaire and Sean Neville are the co-founders of Circle, while Brian Armstrong and Fred Ehrsam are the founders of Coinbase.

Circle and Coinbase formed the Centre Consortium, which oversees the development and governance of USDC.

What are the advantages of using USD Coin?

The advantages of using USD Coin include stability, security, and seamless transactions within the cryptocurrency ecosystem.

With its 1:1 peg to the U.S. dollar, USDC provides a stable alternative for transacting value, eliminating the volatility often associated with other cryptocurrencies.

Are there any risks associated with investing in USD Coins?

Investing in USD Coin carries risks, including counterparty risk, regulatory risks, and market dynamics.

While USDC aims to be fully backed by U.S. dollar reserves, the stability, and trustworthiness depend on the entities holding the reserves.

Regulatory changes and market fluctuations can also impact the value and liquidity of USDC.

Can I use USD Coin for everyday transactions?

Yes, USD Coin can be used for everyday transactions just like any other digital currency.

Are there any transaction fees associated with using USD Coin?

Transaction fees may vary depending on the platform or exchange you use for USD Coin transactions.

However, compared to traditional financial systems, the fees associated with using USD Coins are often lower.

It’s important to check the specific fee structure of the platform or exchange you are using for accurate information.

Can I convert USD Coin back to fiat currency?

Yes, you can convert USD Coin back to fiat currency.

When you sell or exchange your USDC, the tokens are burned, and the equivalent amount of U.S. dollars, based on the 1:1 peg, is transferred to your bank account.

This allows you to convert your USDC holdings back to traditional currency when needed.

You are right, it is exact

The same…

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.